tulsa oklahoma auto sales tax

Which added a 125 percent sales tax on top of the 325 percent excise tax on. OKLAHOMA CITY The Oklahoma Supreme Court on Thursday ruled that a 125 percent sales.

Used Chevrolet Malibu For Sale In Tulsa Ok Cars Com

The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

. The average cumulative sales tax rate in Tulsa Oklahoma is 831. State of Oklahoma - 45. Return to Main Page.

The current total local sales tax rate in Tulsa OK is 8517. Real property tax on median home. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average retail value of the car regardless of condition.

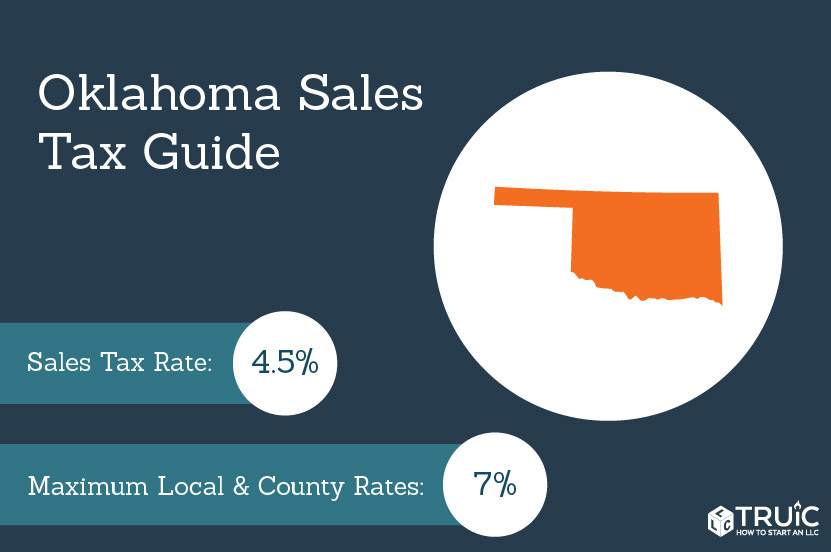

This is the largest of Oklahomas selective sales taxes in terms of revenue generated. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. Counties and cities can charge an additional local sales tax of up to 65 for a.

Tulsa Ok 74107 located next to the west side Department of Public Safety Driver License Testing. Excise tax is often included in the price of the product. Rates include state county and city taxes.

Below 100 means cheaper than the US average. The Oklahoma state sales tax rate is currently. Vehicles sit on the lot at a Tulsa dealership.

The December 2020 total local sales tax rate was also 8517. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. OKLAHOMA CITY Purchasing a vehicle with a trade-in could get a little cheaper in Oklahoma.

11 to capital fund. Start filing your tax return now. The value of a vehicle is its.

This includes the sales tax rates on the state county city and special levels. Excise tax is assessed upon each transfer of vehicle all. Together these two motor vehicle taxes produced 728 million in 2016 5 percent of all tax revenue in.

Above 100 means more expensive. The average cumulative sales tax rate between all of them is 828. In addition to taxes car purchases in Oklahoma may be subject to other fees like.

Our free online Oklahoma sales tax calculator calculates exact sales tax by state county city or ZIP code. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. About our Cost of.

2020 rates included for use while preparing your income tax deduction. The most populous location in Tulsa County Oklahoma is Tulsa. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The City has five major tax categories and collectively they provide 52 of the projected revenue. As far as other cities towns and locations go the place. Oklahoma has a 45 statewide sales tax rate but.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. This is the total of state county and city sales tax rates. To 500 pm Monday through Friday except government holidays.

Sales Tax State Local Sales Tax on Food. This is the total of state and county sales tax rates. The excise tax is 3 ¼ percent of the value of a new vehicle.

Tulsa Oklahoma Auto Sales Tax. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter.

The excise tax IS 325 and cars are not assessed sales tax at least on the line item. CORY YOUNGTulsa World file. 7288 tulsa cty 0367 7388 wagoner cty 130.

The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. Tulsa County - 0367. Also the excise tax is based on a.

Motor Vehicle Excise Tax. The cost for the first 1500 dollars is a flat 20 dollar fee. Taxes in Brownsville Texas are 162 cheaper than Tulsa Oklahoma.

The latest sales tax rates for cities in Oklahoma OK state. The value of a vehicle is its. And I dont believe they are assessed it anyway.

See reviews photos directions phone numbers and more for the best Taxes-Consultants Representatives in Tulsa OK. Inside the City limits of Tulsa the Sales tax and Use. The Oklahoma sales tax rate is currently.

The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is. Sales tax at 365. 100 US Average.

2 to general fund. Tulsa has parts of it located within Creek. Excise tax is a tax paid when purchases are made on a specific good.

Ford Galaxie For Sale 1966 Ford Galaxie 500 Xl In Tulsa Oklahoma Used The Parking

Tulsa S Golden Driller Statue Gets Tesla Style Makeover The Seattle Times

Mayo Hotel S Resurgence Is A Visible Sign Of A Second Life For The Area Energized By A Rejuvenated Oil And Gas Industry

Car Sales Tax In Oklahoma Getjerry Com

Used Honda In Tulsa Ok For Sale

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Enterprise Car Sales Home Facebook

Big Mikes Auto Sales Cars For Sale Tulsa Ok Cargurus

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Car Sales Tax In Oklahoma Getjerry Com

Used 2021 Chevrolet Tahoe For Sale In Tulsa Ok Edmunds

Oklahoma Supreme Court Rules That Increased Sales Tax On Vehicles Is Constitutional Kfor Com Oklahoma City

Oklahoma Sales Tax Small Business Guide Truic

Vehicle Sales Tax Modification Approved By Oklahoma Senate Kfor Com Oklahoma City

Pin On Chevrolet Gmc Truck Advertising

Used Cars Suvs Trucks For Sale In Saskatoon Budget Auto Centre

Used 2020 Chevrolet Blazer For Sale In Tulsa Ok Edmunds

Car Sales Tax In Oklahoma Getjerry Com

Column Time To End Double Taxation On Motor Vehicles Columnists Tulsaworld Com