maryland student loan tax credit status

Complete the Student Loan Debt Relief Tax Credit application. Enter the total level of tax credit up to 5000 being claimed based upon the total eligible undergraduate student loan debt balance as of submission of the tax credit application.

Student Loan Forgiveness Statistics 2022 Pslf Data

About the Company 2021 Maryland Student Loan Debt Relief Tax Credit Program.

. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund. Student Loans - Financial Regulation. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying.

For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refundUnder Maryland law the. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans from an accredited college or university. CuraDebt is an organization that deals with debt relief in Hollywood Florida.

If the credit is more than the taxes you would otherwise owe you will receive a. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. April 29 2022 About the Ombudsman.

The plan was modeled after and designed to be similar in principle to the. Since launching in 2017 more than 40600 residents have received a credit through the Maryland Student Loan Debt Relief Tax Credit Program and the state has dispersed nearly. On May 15 2018 Governor Larry Hogan.

Under Maryland law the. Enter the tax year of the tax credit that was awarded. From July 1 2022 through September 15 2022.

Welcome to the Student Loan Ombudsman - Financial Regulation Last reviewed or updated. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by.

It was established in 2000 and is. Many individuals and families use student loans to pay for the cost of school tuition and other higher education related expenses. From July 1 2022 through September 15 2022.

Yes it is. The Renters Tax Credit Program provides property tax credits for renters who meet certain requirements. Tax return you must indicate if you have ever receiveda Maryland Student Loan Debt Relief Tax Credit in the past.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying. The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by. Year of Tax Credit.

From the list of Maryland credits select the topic Student Loan Debt Relief Credit You will be asked to enter the amount on the certification from the Maryland. Complete the Student Loan Debt Relief Tax Credit application.

What Are The Pros And Cons Of Student Loan Forgiveness

Unusual Advantages Of Taking A Students Loan Student Loans Education Student Loan Application

Student Loan Debt Statistics In 2021 A Record 1 7 Trillion

How To Claim The Maryland Student Loan Tax Credit Fire Esquire Student Loans Debt Relief Programs Student Loan Debt

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

Learn How The Student Loan Interest Deduction Works

Student Loan Refinance Pros And Cons White Coat Investor

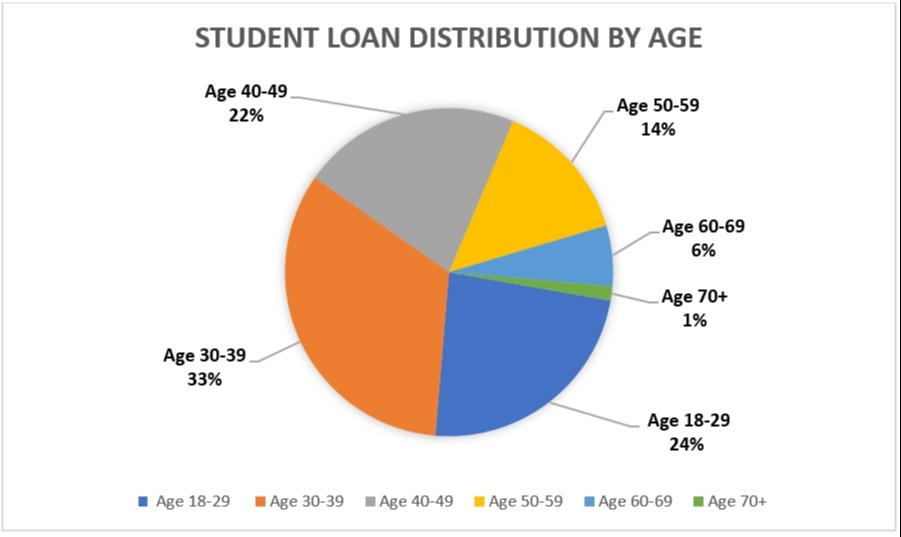

Who Owes The Most Student Loan Debt

The Chief Executive Of R3 Is Reportedly Making A Statement To Emphasize That R3 Is Not Near Bankruptcy The Statement Was Pu Bankruptcy Insolvency Debt Relief

Most College Students Spend Loan Money On Summer Expenses Survey Student Loan Hero

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Banks Pare Student Loan Exposure Business Line Student Loans Student Exposure

Current Student Loans News For The Week Of Feb 14 2022 Bankrate

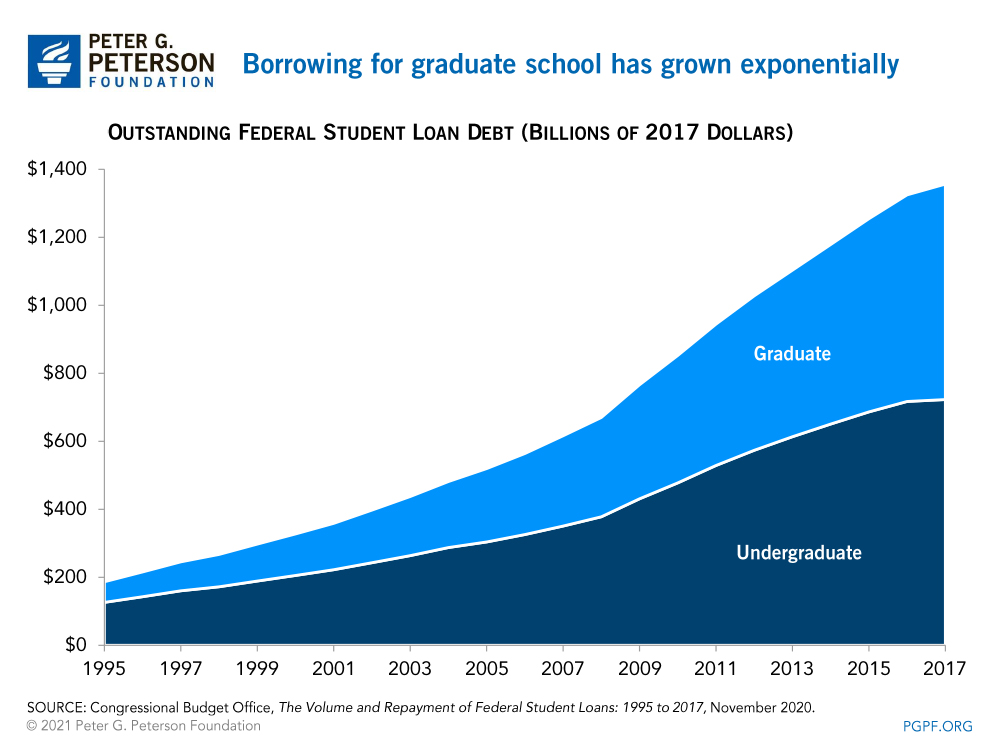

Student Debt Has Increased Sevenfold Over The Last Couple Decades Here S Why

Statistics Concerning Student Loan And Borrower Characteristics

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor